Welcome to Wisconsin.

From the moment Wisconsin achieved statehood, our motto has always been “Forward.” That means you’ll find incredible support for your company’s vision as well as excitement around bringing that vision to life. From inbound foreign direct investment to domestic relocation, WEDC and its statewide network can help you find prime locations and connect you with valuable resources that set you up for success in Wisconsin.

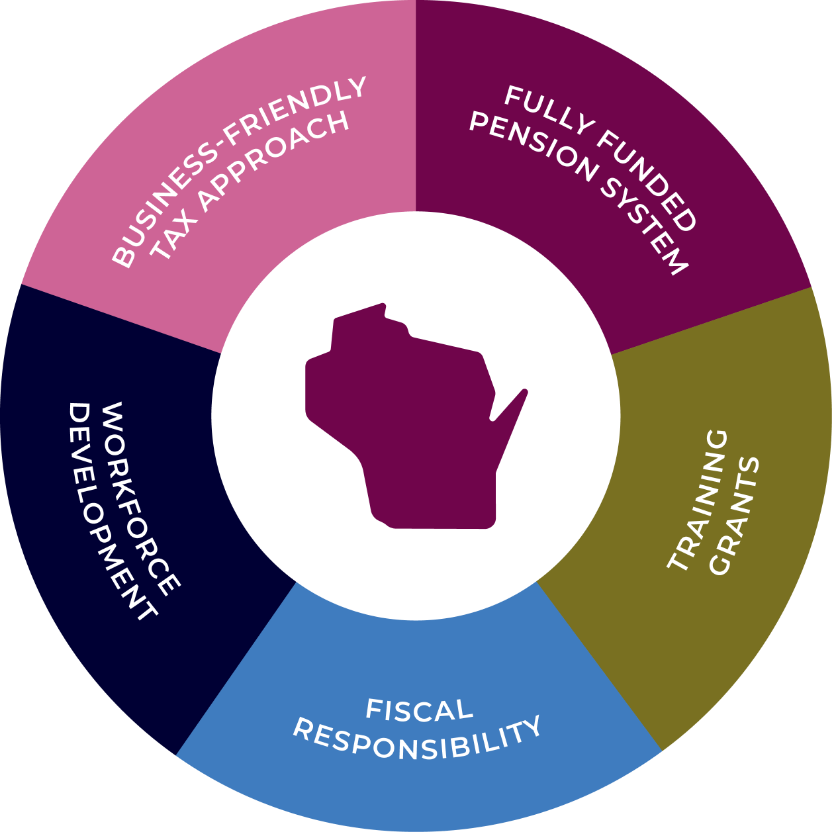

Business Climate

When we say “Welcome to Wisconsin,” we mean it. You’ll find business-friendly tax code, low regulation, policies that advance emerging industries and allow your business to compete nationally and globally, and an environment that spurs investment and instills confidence in the future.

In addition, you’ll have access to programs and resources to help you start, relocate, or expand your business in Wisconsin. Through WEDC’s collaboration with local and regional economic development organizations, academia, and industry associations, you’ll be connected to growth-oriented solutions to help maximize your company’s potential.

#1

in the nation for manufacturing jobs as a percentage of total workforce

Source: Business Facilities magazine, July/August 2022

1/3

of population with a bachelor’s degree or higher

Source: U.S. Census American

Communities Survey, 2021

Abundant

natural resources and low risk of natural disaster

Source: WEDC FY23 Annual Report on Economic Development

Let’s explore Wisconsin’s advantages.

Fiscal Stability

Wisconsin is one of the most fiscally responsible states in the nation. Learn more about our stewardship and stability. Learn More

Location and Infrastructure

A central location and well-developed transportation, from rail to commercial ports and international airports, make Wisconsin a smart choice. Learn More

Research and Development

Wisconsin features one of the nation’s largest research enterprises and a robust network to provide the innovation your company needs. Learn More

Skilled Workforce

Wisconsin has a rich manufacturing heritage and is a national leader in education. We have the talent you need today—and tomorrow. Learn MoreLet’s tour prime locations in Wisconsin.

Certified Sites

For low risk and quick turnaround times and approvals, choose a Wisconsin Certified Site for your industrial space. Search Sites

Available Sites

Find the perfect community and space, building, or site for your business. Search LocationsJoin companies that are finding success in Wisconsin.